Anúncios

Fast cash in your account and full control over your repayment schedule.

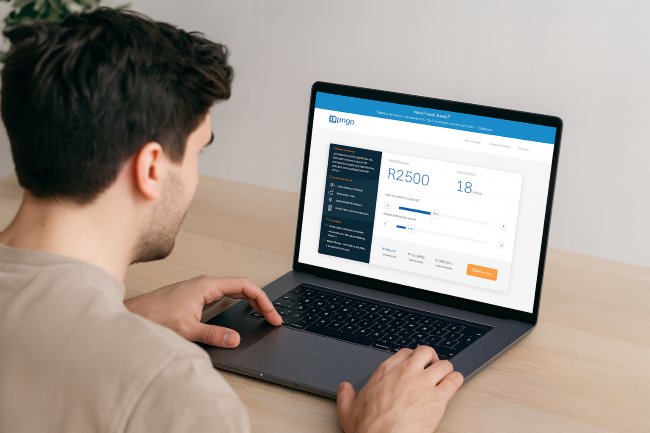

Wonga’s quick loan is a practical option for anyone who needs money urgently and wants to avoid the bureaucracy of traditional banks.

With a fully online process, you can request credit simply and securely, anytime, from anywhere.

Wonga’s goal is to offer speed without sacrificing transparency. You know exactly how much you’ll pay before confirming your loan.

If you’re looking for a reliable, hassle-free solution that fits your budget, check out Wonga’s quick loan: flexible, safe, and perfect for emergencies!

Get to know Wonga’s quick loan: flexible, safe, and perfect for emergencies.

Wonga’s quick loan is offered by Wonga Online (Pty) Ltd, a trustworthy South African fintech operating in the financial market since 2011.

Registered with the National Credit Regulator, Wonga adheres to strict credit guidelines and offers responsible lending with transparency, security, and speed at every stage.

New clients can apply for loans ranging from R500 to R4,000, while returning customers with good credit history may borrow up to R8,000.

With flexible terms from 6 days to 6 months, Wonga offers online simulations, fast approval, and early repayment without extra charges.

Key benefits of Wonga’s quick loan

Wonga’s quick loan is the ideal choice for those seeking convenience, speed, and full control when facing financial emergencies.

More than just fast, it’s a clear and hassle-free experience designed to simplify your life from start to finish. Best of all: at your pace.

100% Online Process

Wonga allows you to do everything from the comfort of your own home: simulate, apply, and track your loan using only your phone or computer.

With this digital process, there are no queues, paperwork, or wasted time. It’s the perfect solution for people with busy schedules.

Additionally, the system is user-friendly, even for those less familiar with technology. Everything is explained clearly and simply.

Wonga’s quick loan was created to be accessible, safe, and efficient, offering a fully digital and customer-friendly experience from the first click.

Fast Deposit

Once your request is approved, the money is deposited directly into your bank account, usually on the same business day. Now that’s speed!

It’s ideal for emergencies that can’t wait, like unexpected repairs, medical expenses, or any situation requiring an immediate financial solution.

You won’t have to wait days to access your funds. Wonga understands that time is critical when solving urgent financial matters.

With speed and efficiency, they deliver on their promise: fast money in your account, with no fuss, exactly when you need it most.

Transparent Simulation

Before confirming your request, you can simulate your desired amount and term and see exactly how much you’ll pay—no surprises.

The simulation tool is intuitive and displays interest, fees, and instalments in real time, helping you make informed decisions with confidence.

Transparency is one of Wonga’s key pillars, ensuring that clients have full control over their choices, even before they confirm their loans.

There is no fine print or hidden charges here: you’ll know everything upfront. Clarity and trust walk hand in hand from the very beginning.

Flexible Amounts and Terms

With Wonga, you choose how much you want to borrow and how long you need to repay within the company’s available limits.

New customers can request loans from R500 to R4,000, while loyal clients may access amounts of up to R8,000.

Repayment terms are also flexible: from just 6 days to up to 6 months, tailored to your budget and payment ability.

This freedom of choice allows you to design the ideal loan for your needs with no pressure and greater peace of mind.

No Fees for Early Repayment

If you wish to repay the loan early, you can do so without incurring any penalties or additional charges.

This benefit helps you save on interest and gives you full control over your debt by allowing you to repay sooner and pay less.

Unlike many institutions, Wonga rewards organized clients and doesn’t apply hidden fees for closing the loan ahead of schedule.

It’s a fair way to encourage responsible borrowing without putting up roadblocks for those ready to clear their debt early.

Fast Approval with Automated Credit Check

When you apply, your information is processed through an automated system that evaluates your ability to repay smartly and efficiently.

This system eliminates long delays and provides a significantly faster response while maintaining responsible lending practices.

The check is based on real data, not just credit history, making the process fairer and more accessible for different profiles.

You receive a response within minutes and can move forward or adjust the details with total clarity and agility.

Possibility of Higher Limits with a Good Payment History

Customers who use the service responsibly and pay on time may be eligible for higher limits and more flexible terms.

Wonga’s quick loans value loyalty and good financial behaviour, building a relationship of trust over time.

This recognition enables you to expand your credit access based on your positive track record, eliminating the need for reapplication.

It’s a smart and respectful way to offer credit based on your consistency and the commitment shown in your payments.

Eligibility requirements to apply for Wonga’s quick loan

Applying for Wonga’s quick loan is simple, but you need to meet a few basic requirements to ensure a secure, fast, and smooth process.

You must be over 18, have a valid South African ID, and be in good standing with your local tax registration.

You also need to have an active bank account with one of the major banks and provide proof of a steady monthly income.

These criteria ensure that Wonga’s quick loan is granted responsibly, always respecting your financial profile without overburdening your budget.

Step-by-step guide to apply for Wonga’s quick loan

Applying for a loan with Wonga is easy, fast, and completely online. Here’s how to do it in just a few steps from your phone:

Loan

Wonga

- Visit Wonga’s official website: Go to Wonga’s website on your phone or computer and click the option to simulate your desired amount and term.

- Simulate your loan amount: Use the sliders to choose how much you want to borrow and how long you’ll take to repay. The full cost appears instantly.

- Fill in your details and upload documents: Please enter your personal and banking information and upload the requested documents, such as your ID and a recent bank statement, for review.

- Wait for approval and receive your funds: Approval is quick, and if accepted, the money is deposited into your bank account on the same business day.

The entire process is simple and transparent, designed to provide you with exactly what you need when you need a fast financial solution.

Main fees applied to Wonga’s quick loan

Wonga’s quick loan is transparent with fees, but it’s important to understand each one before borrowing so you can make an informed and safe decision.

In addition to interest, there are fixed fees that impact your total cost. After all, borrowing money always comes at a price.

Monthly Interest Rate

Interest is applied to the amount borrowed and varies based on your risk profile and the loan’s repayment term.

For example, if you borrow R1,000 for 30 days at 5% interest, you’ll pay R50 in interest at the end of the term.

At Wonga, new customers typically pay a maximum of 5%, but returning clients with a good record may qualify for lower rates.

This rate is calculated monthly but applied proportionally to the number of days in the loan, so shorter terms mean less interest.

Monthly Service Fee

The service fee covers administrative costs and customer support and is fixed at R69 per month, in line with credit regulations.

Let’s say your loan lasts two months: you’ll pay R69 each month, totalling R138 for this administrative fee.

If the term is less than a month, Wonga applies the service fee proportionally, so you pay only what’s fair.

This amount is included in the final cost and displayed in the simulation before you sign the contract.

Initiation Fee

This one-time fee is charged at the start of your loan to cover the evaluation and contract setup costs.

For example, if you borrow R2,000, the initiation fee may be around R300, depending on the percentage applied.

Wonga calculates this based on National Credit Act guidelines, limiting the fee according to the loan amount.

It’s already included in your total repayment amount and shown clearly in the simulation before you confirm.

Late Payment Penalty

If you miss a due date, Wonga applies a penalty and additional interest, as outlined in your agreement.

Let’s say your instalment is R1,500. A late payment may incur a R50 penalty, plus daily interest, which will increase the total amount.

Wonga’s quick loan encourages timely payments and sends reminders before the due date to help you avoid extra charges.

Staying on track helps maintain a clean credit profile and can unlock higher limits and better terms in future applications.

Conclusion

Wonga’s quick loan stands out for its transparency, speed, and convenience, making it a smart choice for anyone who needs money quickly and hassle-free.

With clearly explained fees, a fully online process, and flexible amounts, it fits your needs and respects your financial plan.

The support is readily available, and the evaluation system is fair, ensuring a seamless experience from application to final repayment.

Like what you read? Would you like to explore another reliable and practical option for emergencies? Then check out the article below on FinChoice KwikAdvance Quick Loan!

Recommended Content